Juan Gervasoni

Specialist

December 11, 2025

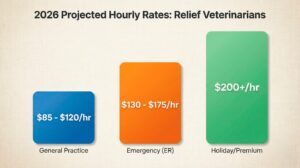

Relief veterinarian rates are shifting rapidly as we approach 2026. The days of a standardized “flat rate” for relief shifts are gone, and specialized consultants are now commanding premium pay.

But with economic fluctuations and new compensation models popping up, one urgent question dominates the conversation: “What should I actually be charging?”

Whether you are looking to transition to relief vet work or you are a seasoned locum, this is your no-nonsense guide to relief veterinarian rates for the 2026 horizon.

While rates vary wildly by location and urgency, we are seeing clear benchmarks stabilizing. According to recent economic reports from the AVMA (American Veterinary Medical Association), the demand for veterinary services continues to outpace the supply of practitioners, putting upward pressure on wages.

For standard scheduled shifts (vaccines, wellness, routine surgery), the national average has nudged upward.

Insider Note: We are seeing a “Reliability Premium.” Clinics are willing to pay the higher end of this bracket for relief vets who arrive prepared. Being familiar with the tools for relief veterinarians, such as common PIMS or having your own stethoscope and scrubs ready, allows you to hit the ground running.

This is where the most significant growth has occurred. However, the intensity is high. To sustain this income level without crashing, we highly recommend reading our guide on veterinary burnout prevention.

Here is the biggest trend to watch for in 2026: The hybrid model. Historically, relief veterinarian rates were based on a flat hourly fee. However, savvy practice managers are now offering “Base + Production” models to incentivize efficiency.

To make this model work for you, you need to master veterinary time management.

For a deeper dive on how to calculate this, check out our previous breakdown on how much a relief vet can earn.

You can negotiate a higher hourly rate if you bring niche skills to the table. In 2026, clinics are paying a premium for:

When you see a rate of $100/hr, remember that as an independent contractor (1099), that is gross income.

The 2026 “Rule of Thumb”: Deduct roughly 30% for taxes.

However, the financial freedom comes from deductions. Smart relief vets utilize LLCs to write off health insurance, travel, and continuing education. It is crucial to understand the difference between an employee and a contractor; the IRS provides specific guidelines that every relief vet should review to ensure they remain compliant.

Note: For our technicians reading this, the landscape is changing for you too! Check out our Vet Tech Salary Guide 2025.

The easiest way to increase your rates is to become the vet that every clinic wants to re-hire.

If you are a practice manager reading this and wondering how to budget for these rates, remember: it’s not just about the money. It’s about culture. To attract top talent, you need to focus on smart hiring strategies and building a positive clinic culture.

Navigating rates, contracts, and schedules can be overwhelming, but you don’t have to do it alone. At FlexVet Staffing, we specialize in connecting talented veterinarians with clinics that value their expertise.

Whether you need help with networking or just want to see what high-paying shifts are available in your area, we are here to support your career journey.